Creating Supplier Debits in MYOB Premier

MYOB allows you to create supplier debits which represent amounts owed to you by your supplier. If you have setup the account for which you are going to record your suppliers’ debit transactions, there is no need for you to create an account for this. Otherwise, you need to create an account to link when entering supplier debit transactions. These debits may represent the following:

- Purchase returns and allowances.

- Debits for damaged item deliveries.

- Other expense accounts, like cost of shipping damaged items to the supplier and the like.

In recording supplier debits, you have the following options to record adjustments for your purchases transactions with your suppliers:

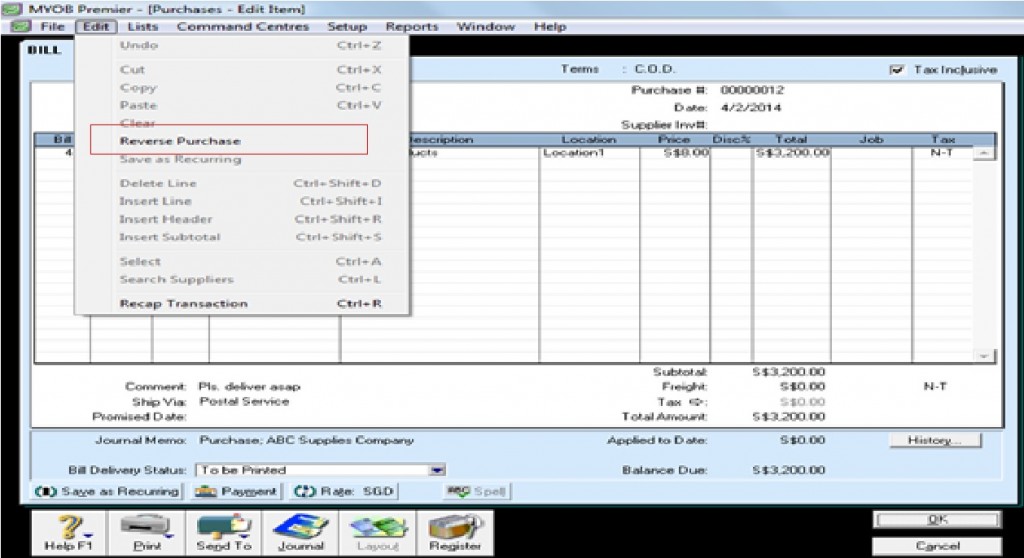

- Reverse the entire purchase transaction if the adjustment or debit pertain to the total amount of purchases. To do this, go to the Purchases Register window and click on bills. Select the purchase you want to delete by clicking on the purchase and then, go to Edit and choose Reverse Purchase and click on Record Reversal in order to save the reversal entry. Please take note that transaction reversal option is activated only if you have setup in Preferences under the Security tab that “Transactions CAN’T be Changed; They Must be Reversed (System-Wide)” as per discussed in previous topic. See screenshot of the window that appear below:

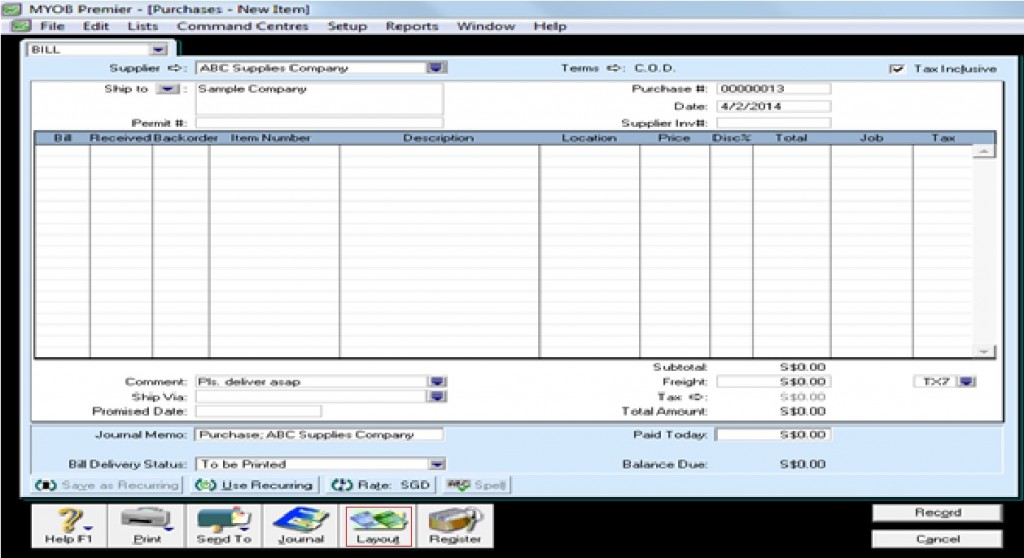

2. Prepare a manual debit entry if the amount for debit is just a portion of your purchase transaction with the supplier for item purchases. To do this, click on Enter Purchases with Bill status. Make sure you have set the bill layout to Item. Fill in the necessary information on the bill for the supplier, date as well as the items for return. However, you have to enter the quantity of the item as negative number. After you have indicated the necessary fields to complete the supplier debit and click on Record to save.

Recording Supplier Debit for non-item Purchase transaction

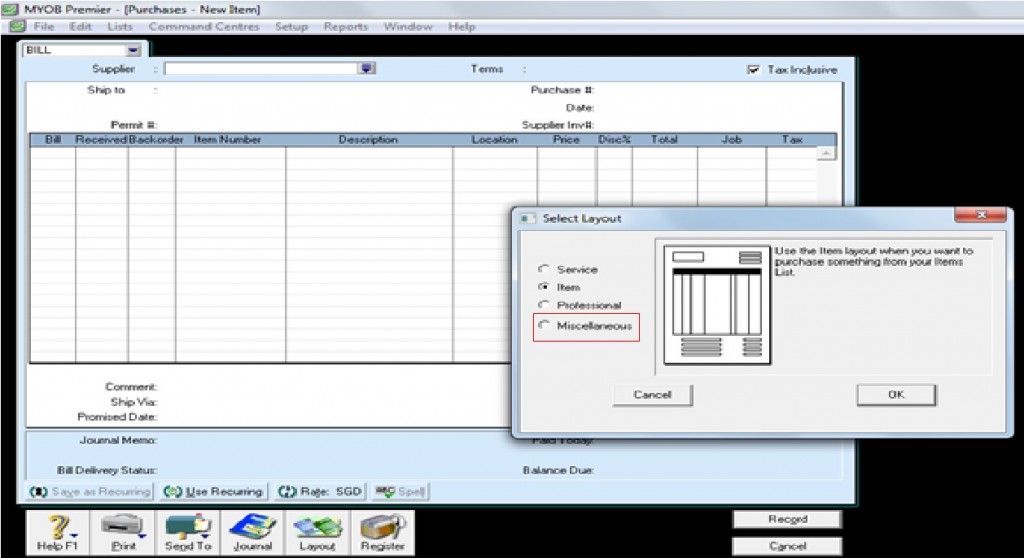

If you are recording other transaction for supplier debit, like charging of a mailing account to your supplier, go to the Enter Purchases option of the Purchases main command centre and click on status as Bill. Set bill Layout as Miscellaneous as per screenshot below:

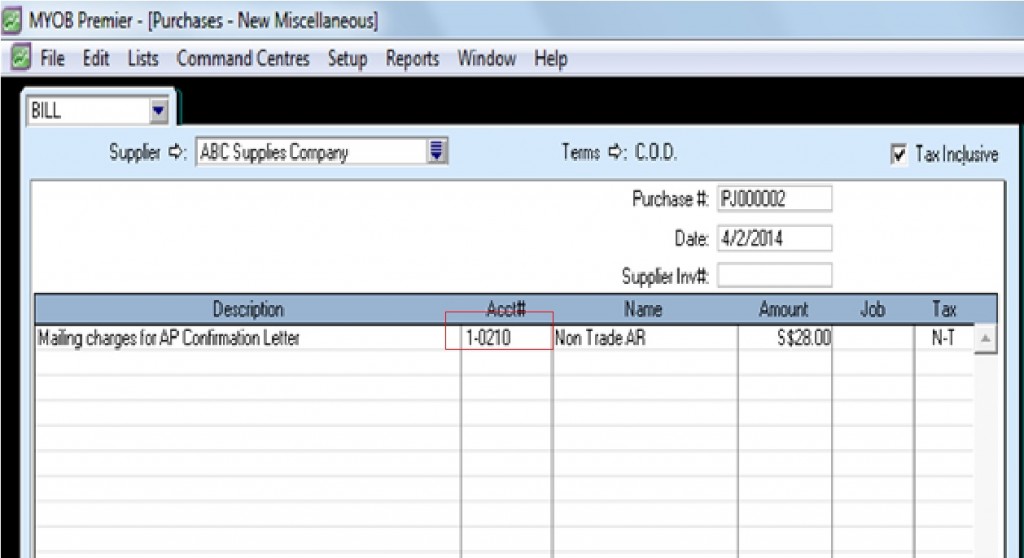

You have to choose the Miscellaneous layout to enable you to make account entries or account entries for which to charge the non-item supplier debit against your supplier. Screenshot for the window is shown below:

Clicking on the Miscellaneous layout allow you to enter Account to charge the supplier debit. Click on Record to save the Miscellaneous bill entry.

Take note that it is best practice to first confirm with your supplier or verify the existence of agreement with regards to purchase returns and allowances, miscellaneous expense charges to be charged against your supplier’s account. Otherwise, recording those charges that are still subject to dispute, only to be waived in favor of the supplier would only mean time and effort wasted in recording these charges since you will end up making adjustment entries or reversing entries previously recorded to recognize the supplier debit.*