Foreign Currency Exchange Rate Loss and Gain

Foreign Currency Exchange Rate, Losses and Gains in MYOB Premier

MYOB Premier is capable of recording foreign currency transactions for the following:

- Purchases, Pay Bills and Settle Returns and Debits

- Sales, Receive Payments and Settle Returns and Credits

- Spend Money, Receive Money, Reconcile Accounts and General Journal Entries

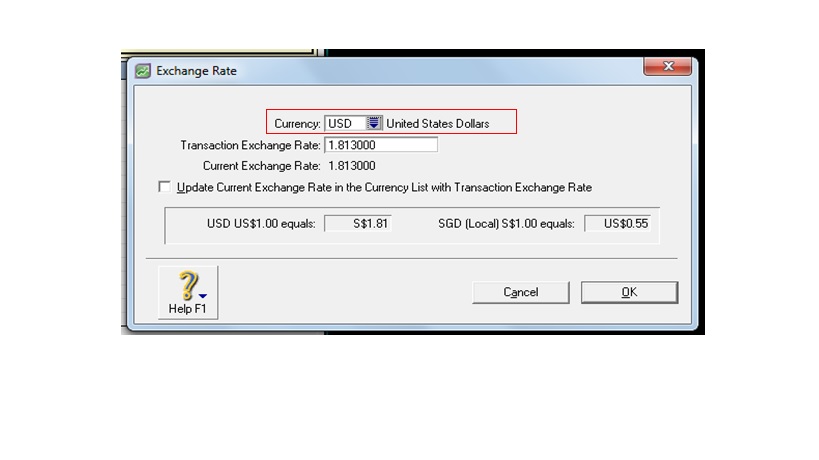

You can enter a new exchange rate for the foreign currency transaction or use the default exchange rate for the currency. To enter a new exchange rate by first using the Currency Calculator. To change the exchange rate:

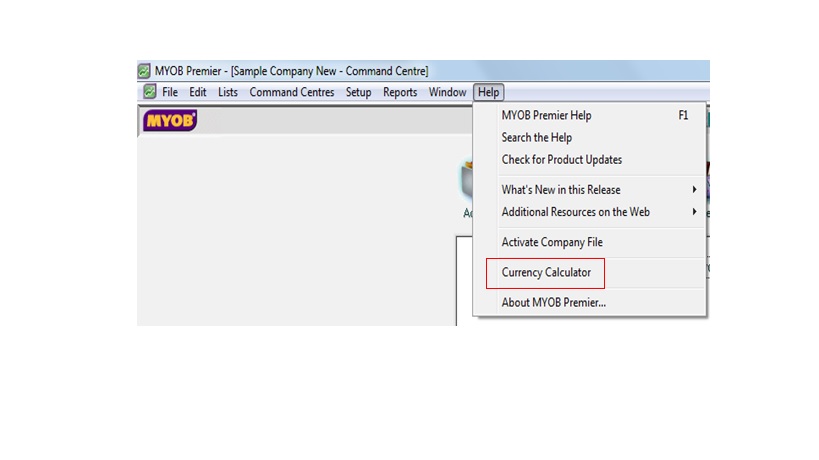

- Using the Currency Calculator, calculate the exchange rate. To go to the Currency Calculator, click on Help and choose Currency Calculator. Please refer to screenshot of the Help window below:

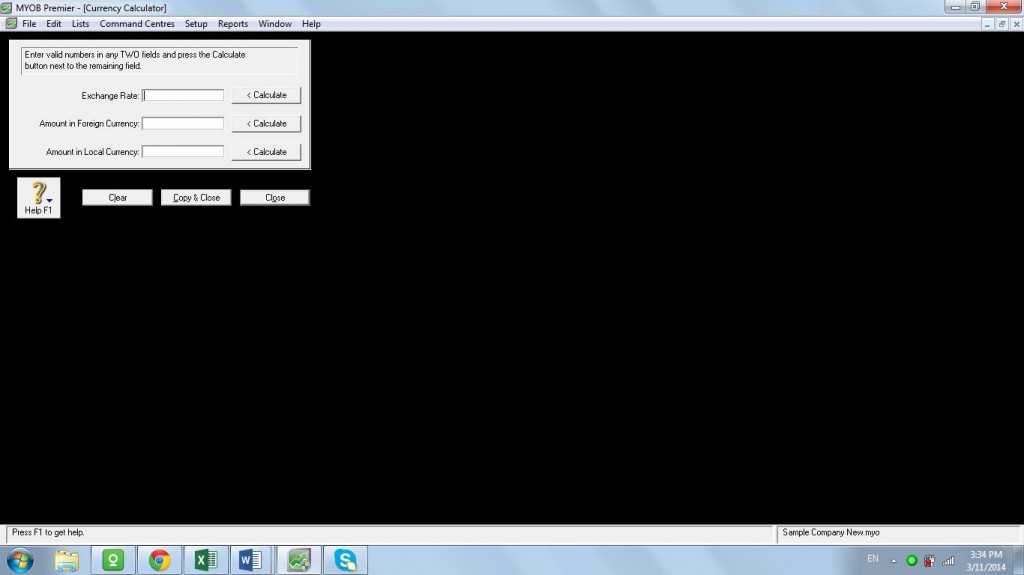

On the Currency Calculator window, enter the transaction details as follows:

You can also use the Currency Calculator to calculate the exchange rate based on the based on the local and foreign currency amount.

How to Track Foreign Currency Gains and Losses

As a principle in foreign currency transactions, any increases or fluctuations in foreign currency value against the local currency give rise to foreign currency gains or losses. However, if the funds from the foreign currency are not yet used to pay for supplier payments, or withdrawn for local currency exchange conversion, the foreign currency gain or loss is still unrealized. The following are the accounts that help you keep track of foreign currency gains or losses:

Realized Currency Gains and Losses

Currency Gains and Losses on Sales and purchases are automatically posted to Realized Currency Gains and Losses whenever a foreign currency payment from customer or payment to supplier is made. The Currency Realised Gain/Loss account is automatically activated when you setup multiple- currency feature in MYOB Premier. The Currency Realised Gain/Loss Report show you and list all the currency gains and losses that are automatically posted through foreign currency sales and purchases for the period.

A general journal entry have to be made to record realized currency gains and losses on bank transfers, deposits and withdrawals as well as foreign currency conversion to local currency.

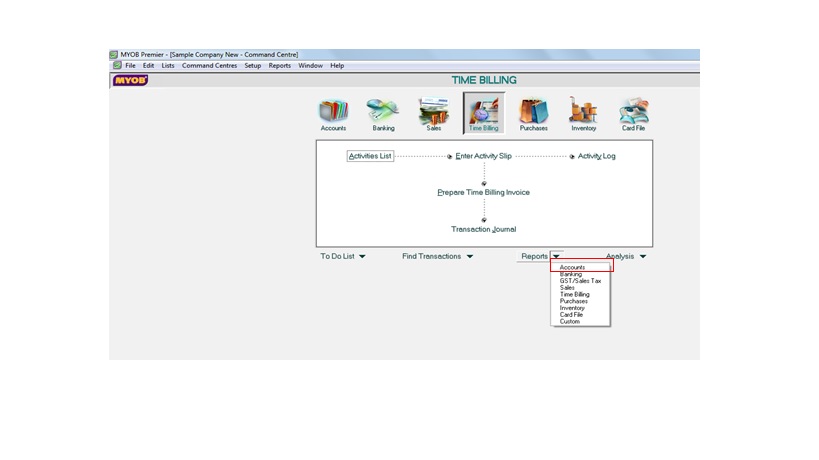

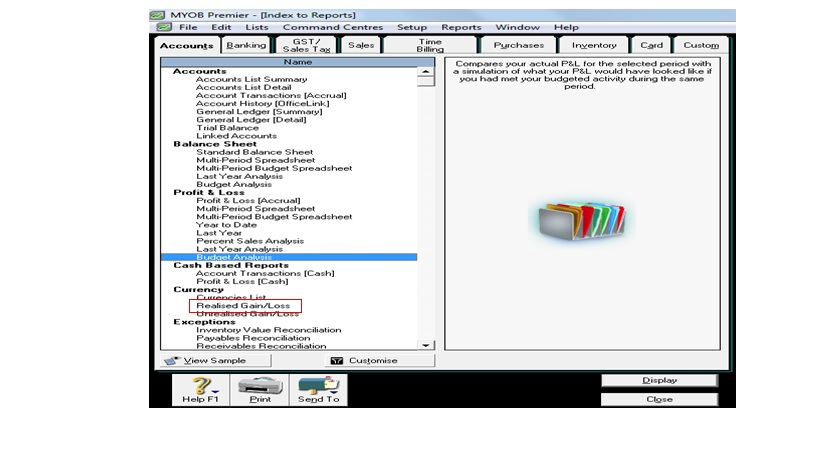

To go to the Realized Currency Gain/Loss Report, go to Reports and choose Accounts.

In the Accounts window, choose Currency, then click on Realized Gain/Loss per screenshot below:

In the Accounts window, choose Currency, then click on Realized Gain/Loss per screenshot below:

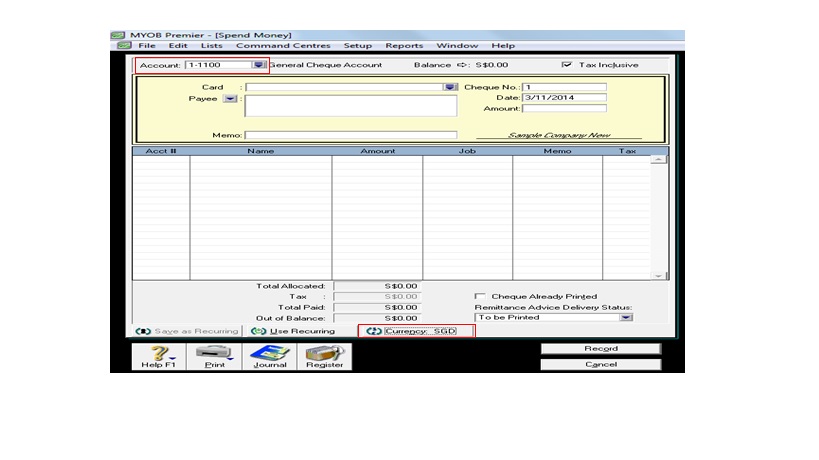

Transferring Funds to a Foreign Account from a Local Currency

There are transactions that require you to record transfer of funds from your local currency to a foreign currency account. To do this, go to the Banking main command centre and click on Spend Money. The Account to be indicated should be the account for the local currency. On the Spend Money window, click on Currency button and choose the foreign currency you are going to enter, for example, US dollars. Screenshot of the window appear below:

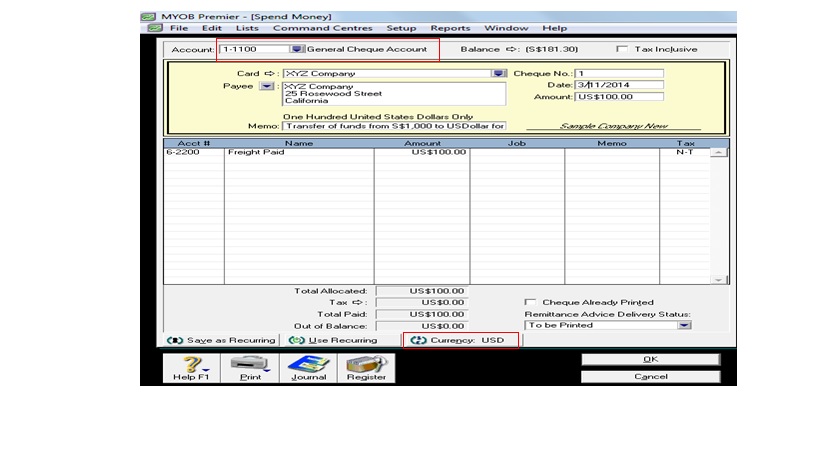

Assuming you are going to transfer funds for US$100.00 for payment of freight not chargeable to item purchases from the supplier. Supplier name is XYZ Company which have a currency profile for US$ previously setup. To enter the information, fill in the necessary field as screenshot below:

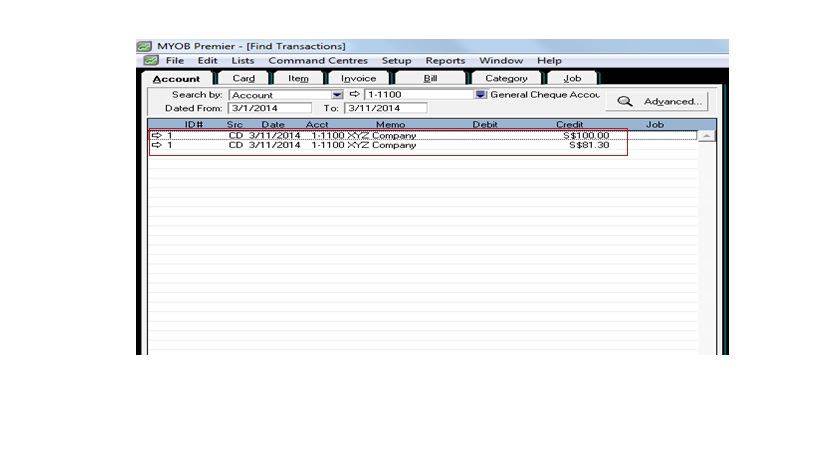

Take note that the amount recorded for payment is US$100.00 in this window. However, in the general ledger and upon the viewing the transaction window for General Cheque Account 1100, amount shown as recorded is S$181.30 which is the foreign currency conversion of the US dollars to Singapore dollars.

Take note that the amount recorded for payment is US$100.00 in this window. However, in the general ledger and upon the viewing the transaction window for General Cheque Account 1100, amount shown as recorded is S$181.30 which is the foreign currency conversion of the US dollars to Singapore dollars.