How To Perform Bank Reconciliation in MYOB

HOW TO PERFORM BANK RECONCILIATION IN MYOB PREMIER

MYOB Premier provides powerful time-saving tool which enable users to do bank reconciliation on the quickest and easiest way possible. Performing bank reconciliation can be time-consuming process and yes, boring, especially if you are not able to reconcile the balances after several attempts, and it leave you feeling helpless and feel less efficient.

To recap, the purpose of bank reconciliation is to balance the cash in bank balance per the statement given by the bank (called bank statement) against the cash in bank balance per MYOB Premier as of the end of the month. Most often than not, bank reconciliation is also an internal control measure to identify intentional or unintentional unrecorded disbursement transactions, unrecorded deposit transactions, and can be a helpful tool in proper evaluation of internal control put in place to safeguard cash and cash in bank transactions. In order to reconcile the cash in bank balance per bank records (per bank) and book records (per MYOB Premier), items that are not recorded in MYOB but deducted or added in the bank balance as shown by the bank statement should be identified with complete details of the transactions and to make proper adjusting entries after this procedure.

The following are common reconciling items in performing the bank reconciliation:

- Deposit in Transit – this is the term used for deposits made to the bank but not yet reflected in the bank statement. Usually, deposits in transit are those check deposits which are not yet cleared and recorded as deposit in the company’s books but still for recording by the bank upon clearing.

- Cleared checks – checks released to the payees which are endorsed and presented to the bank for payment.

- Outstanding Checks – are check issuances that are already deducted from the cash in bank balance per MYOB but not yet deducted from the bank balance or theoretically, not yet “presented” to the bank for payment or clearing. Actual status of these checks maybe as follows:

3.1. Unreleased Checks – these are checks that are not actually released to the payees and still on hand in company custody.

3.2. Released Checks but not presented by payee to the bank for payment – this could either be dated checks or post-dated checks.

3.3. Released Checks but still in transit or undelivered to the payee.

- Bank Service Charge or charges – usually arise from cost of check books, stop payment orders (SPO), correspondent bank charges and the like.

- Bank Interest income – usually on a monthly basis or as stipulated in the bank service agreement.

- Book error in recording check issuances – whether understatement or overstatement in recording of check amount.

- Book error in recording bank deposits – whether understatement or overstatement in recording of deposit amount.

- Unrecorded deposits and unrecorded check disbursements.

- Other reconciling items that may arise.

Now, let’s perform the bank reconciliation for ABC Stationery Supplies. Assume we receive the bank statement date January 31, 2014 on February 5, 2014. Ending balance show S$39,508.20. Aside from the cleared checks, the following information are present:

1.) Monthly interest of S$18.20 credited to the account on January 31, 2014

2.) Check no. 68007 amounting to S$225.75 still not presented for payment.

3.) Bank charge for stop payment order amounting to S$25.00 debited by bank on January 31, 2014.

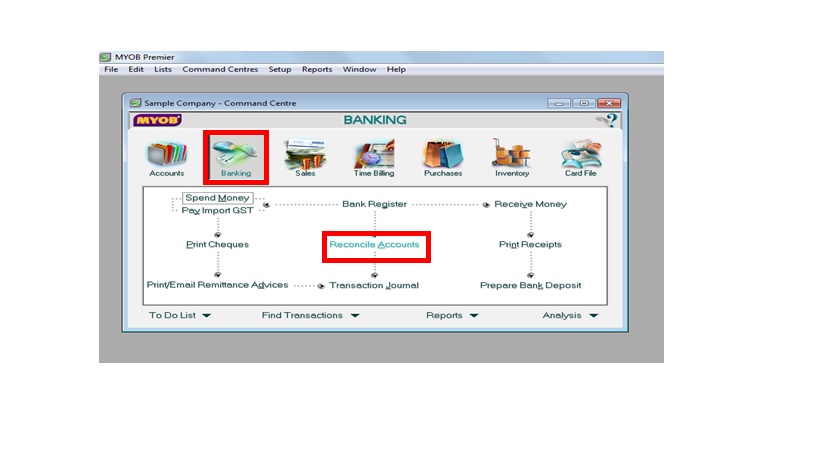

To start the bank reconciliation, go to Banking Command Centre and click on Reconcile Accounts

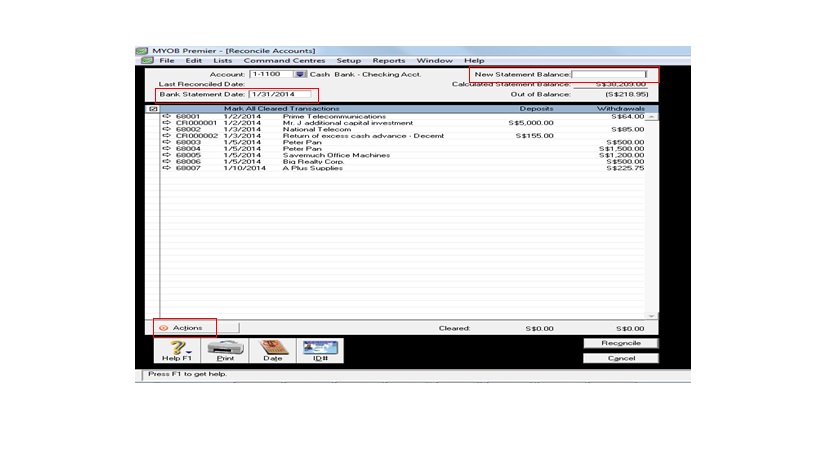

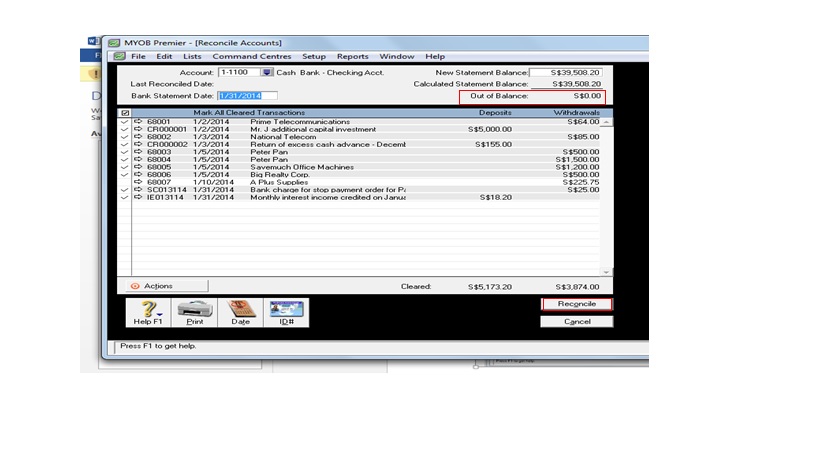

The following screen appears after keying in Statement Date of January 31, 2014:

The following screen appears after keying in Statement Date of January 31, 2014:

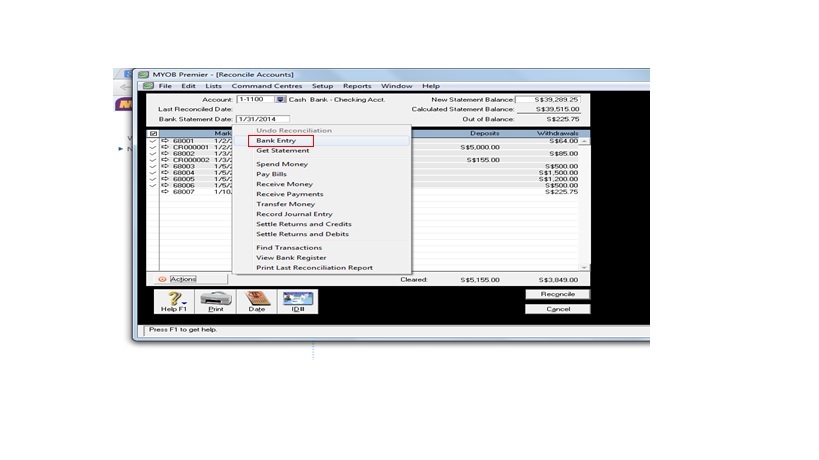

Now, indicate the amount of bank balance on New Statement Balance. Click on the left portion of the cleared deposits and cheque issuances except the outstanding check no. 68007 amounting to S$225.75. To make the adjusting entries for the bank charge and interest income, click on Actions, and the screen below appears to make the adjusting entries:

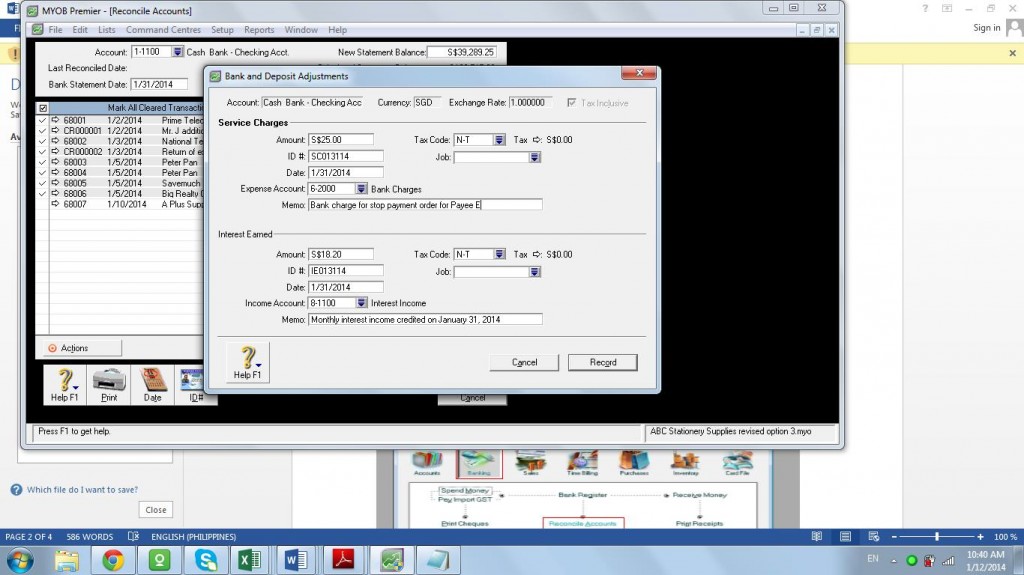

When the Bank Entry screen appear, key in the amount of the bank charge, interest income, respectively and fill up the correct Expense Account for the bank charge, and correct Income Account for the interest income. Enter the amounts as positive numbers Screen appear as follows before clicking on Record to save the bank entry:

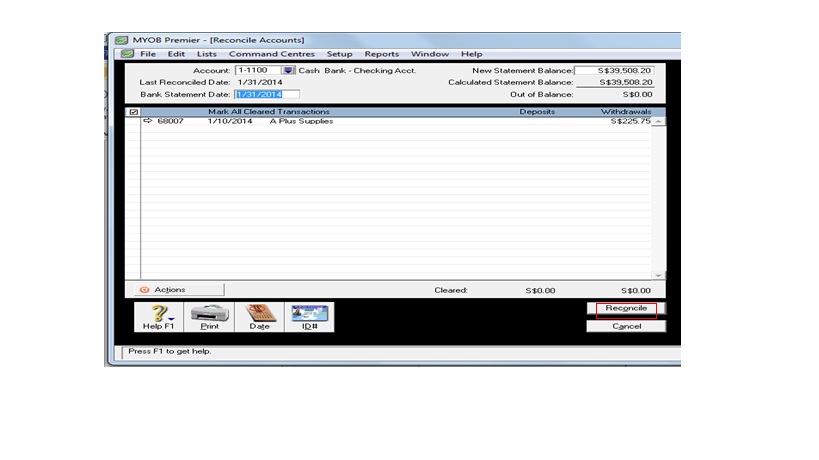

Once Record is clicked on the Bank Entry screen, the screen now revert back to the bank reconciliation screen. Take note the Out of Balance portion is now Zero as shown below.

Click on Reconcile, choose Print Report to print a printed copy of the reconciliation. After printing desired number of copies of Reconciliation Report, click Reconcile, screen below appears:

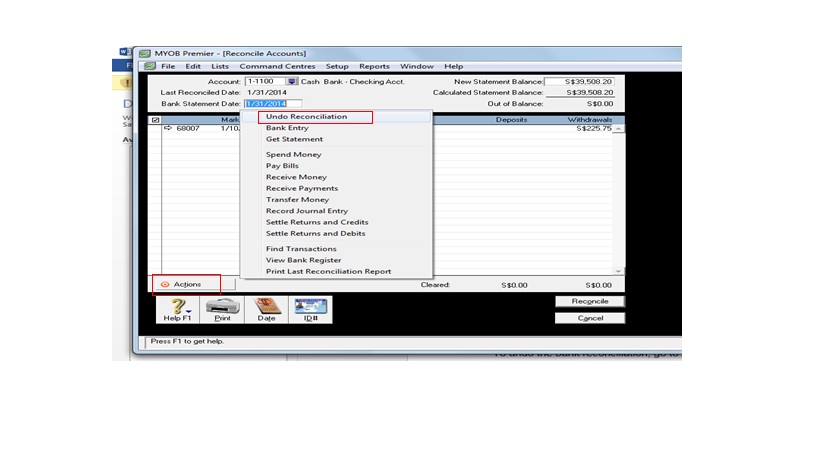

How to Undo a Bank Reconciliation previously done in MYOB Premier

How to Undo a Bank Reconciliation previously done in MYOB Premier

If you want to undo the bank reconciliation, go to Actions, click on Undo Reconciliation

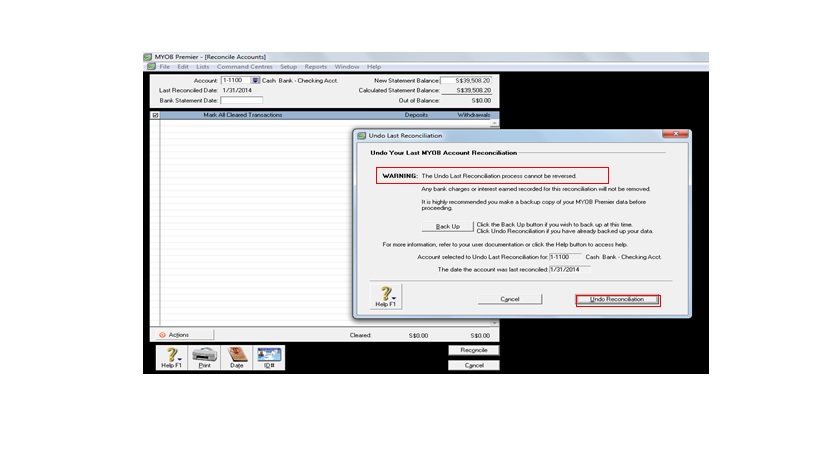

The screen now appear to remind Backup of MYOB file before proceeding to Undo Reconciliation.

The screen now appear to remind Backup of MYOB file before proceeding to Undo Reconciliation.

Click on Undo Reconciliation to proceed if you want to undo the bank reconciliation.

Click on Undo Reconciliation to proceed if you want to undo the bank reconciliation.