Sale of Items with Insufficient Inventory in MYOB

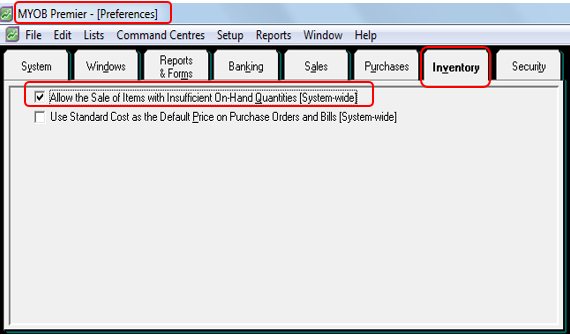

MYOB have built-in feature to allow you to record sale even with insufficient inventory available on hand. To do this, you have to set up in the Setup Preferences under the Inventory tab to “Allow the Sale of Items with Insufficient On-Hand Quantities [System-wide]. Take note that recording sales of items with insufficient inventory will result to negative inventory figures and values and may affect not only the values but the costing of the item as well. Below is the screenshot on setting up the Preferences.

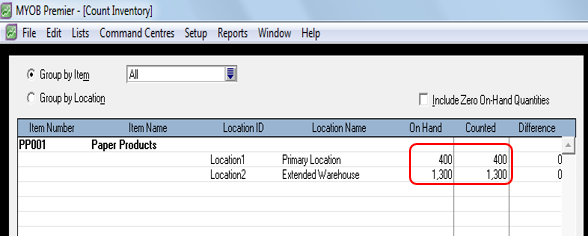

For illustration purposes, assume that Sample Company is going to sell 2,000 units of PP01 Paper Products but only have 1,700 total units on hand from all warehouse locations as per screenshot below:

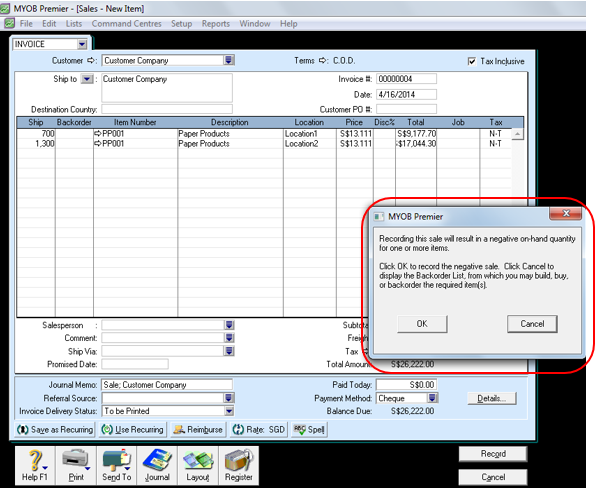

When you try to record the sale of 2,000 units of PP001 Paper Products, MYOB will prompt that the inventory would result to negative quantity as per screenshot below:

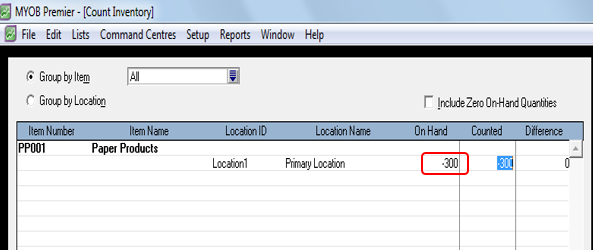

To proceed recording of the sale even if the transaction result to negative inventory quantities and values, click on OK. After saving the sale transaction, the inventory count of the item reflect a negative balance of 300 units in Location 1 as per screenshot below:

Take note that you cannot record the above sale if you keep track of the item movement and if you have not set up this Inventory Preference for allowing recording of sale with negative on-hand quantities unless you have actually recorded receipt of the unavailable items. This feature, however, provide more control on your inventory figures and most likely don’t result to reconciling items in your inventory quantities and values.

You can also opt to create an order and buy the unavailable inventory or back order the item in order to proceed recording the sale.

When sale of items with insufficient quantities is recorded, the cost that is recorded is actually not the cost but would be based on an estimated cost for recording purposes. Take note that when the insufficient is subsequently purchased, the difference of the actual purchase cost from the estimated inventory cost is recorded in the automatic journal entry that will be generated. The estimated cost of the item would be based on the following in the order of priority:

1) Average Cost – this costing method is first used when you have available stock on hand for the sold item and the unavailable quantity will be computed with cost based on unit cost of the available item.

2) Last Cost – in the absence of average cost data, the estimated cost will be based on the last cost of the item.

3) Standard Cost – this cost method will be used if you have never purchased the item before but you have set up a standard cost for the item under the Buying Details tab when you have created or set up the item. This procedure is discussed in the previous topic How to Set Up Items in MYOB Premier.

4) Zero cost – this cost is used when you have not purchased the item and you opt to assign a zero cost for the unavailable item.